Pricing

Know the price as you file!

With Tax•visor, you will know how much your taxes will cost upfront. So, you are not caught off guard by us.

Several factors play a role in the calculation of the fee: Which kind of service? Does the processing take long? How many issues must be clarified?

Before you mandate us we estimate these factors and you get a thorough indication for the approximate fee.

Different services, different prices

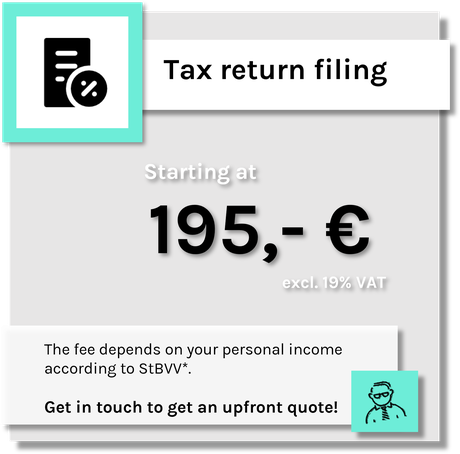

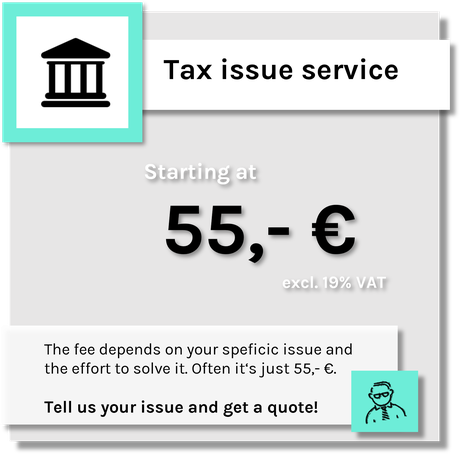

It is regulated by law, according to which factors the fee must be calculated. They are charged according to the Tax Consultant's Fee Directive ('Steuerberatervergütungsverordnung' (StBVV)).

The fees for the individual tax preparation services are based on certain item values (e.g. turnover, amount of income). Other services may be charged based on hourly charges.

Our prices

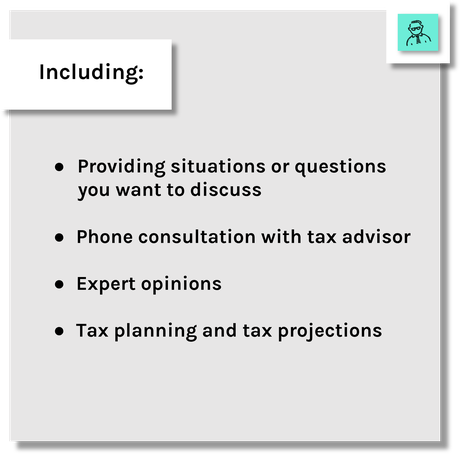

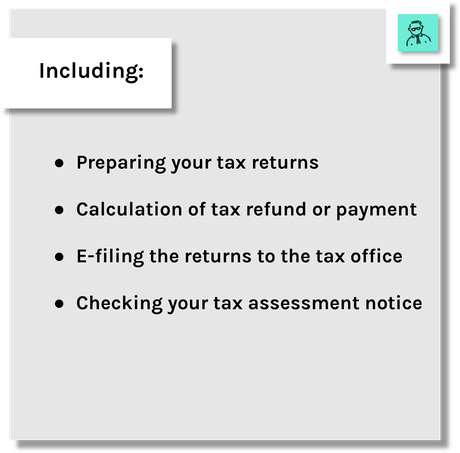

Before you start working with us we give you a clear indication of the individual fee. Below you can find the standard starting prices for the different kinds of our services.

Interested? Get in touch!

Are you interested in working with us? Or do you have further questions about our tax consultancy, our services or other special topics?

Then contact us! You reach us in various ways. Just choose the most convenient one for you.

© 2022 Tax•visor // All rights reserved. // Made in Elmshorn.